Filing a comprehensive insurance claim for glass is something every vehicle owner may face at some point. Whether your windshield is chipped by flying gravel or cracked during a storm, understanding how to file a claim correctly ensures you get fast repairs without unnecessary stress or expense.

Understanding Comprehensive Coverage for Glass Damage

Comprehensive insurance covers damage to your vehicle from non-collision incidents, and glass damage is one of the most common claims. It typically includes:

- Windshield cracks or chips caused by road debris

- Broken windows from theft, vandalism, or weather events

- Damage from falling objects like branches or hail

- Shattered sunroofs or mirrors

Every insurance policy has its own rules about deductibles and coverage. Some insurers include full glass coverage with no deductible, while others require a small payment from you. Always review your policy details or contact your insurance provider before starting the claim process.

Evaluate the Damage Before Filing

Before filing a claim, take a moment to inspect the damage and decide if it’s worth filing.

Key Factors to Consider

- Size and location of damage: Small chips can often be repaired inexpensively, but large cracks or anything in the driver’s view usually require full replacement.

- Repair cost vs. deductible: If the repair cost is less than or close to your deductible, paying out-of-pocket may make more sense.

- Type of glass: Windshields, side windows, and rear windows may have different claim processes and costs.

Taking these steps early helps you make an informed decision and avoid unnecessary claims that might affect future premiums.

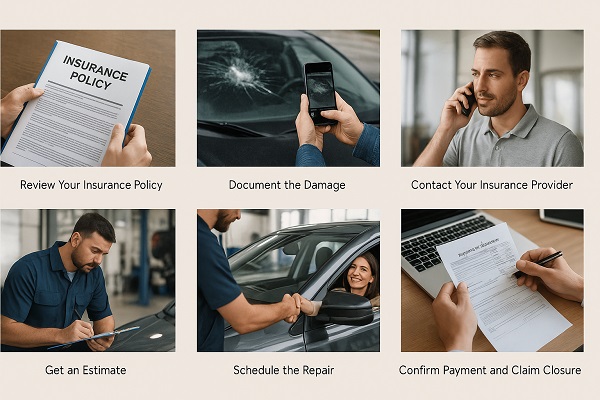

Step-by-Step: How to File a Comprehensive Insurance Claim for Glass

Filing a glass claim doesn’t have to be complicated. Here’s a clear process for personal vehicle owners to follow.

1. Review Your Insurance Policy

Log into your insurance account or read your policy documents to confirm:

- Glass damage is covered under your comprehensive insurance

- The deductible amount and whether full glass coverage applies

- Any preferred repair partners your insurer recommends

Knowing this information ahead of time helps prevent surprises during the claim process.

2. Document the Damage

Take multiple clear photos of the glass damage from different angles. Include one that shows the whole vehicle, the damaged area up close, and your license plate. Proper documentation can help your insurer verify the cause and extent of damage quickly.

3. Contact Your Insurance Provider

You can usually file your claim through your insurer’s:

- Mobile app

- Online claim center

- Customer service line

Provide details about the damage, such as how and when it happened, along with your photos and contact information. Most insurance companies respond quickly to glass claims since they’re common and straightforward.

4. Get an Estimate

Your insurer may refer you to an approved glass repair company or allow you to choose your own. Request an estimate to determine whether a repair or full replacement is needed. Using an insurer-approved shop can help streamline billing and avoid delays.

5. Schedule the Repair

Once approved, set up a repair appointment. Many glass service companies offer mobile repairs, allowing you to get your windshield fixed at home or work for convenience.

6. Confirm Payment and Claim Closure

After the work is complete, verify your insurer has paid the service provider directly or reimbursed you if you paid upfront. Keep all invoices and claim documents for your records.

Common Mistakes to Avoid When Filing a Glass Claim

Even simple claims can get delayed if you overlook important steps. Avoid these frequent mistakes:

- Waiting too long to report damage

- Forgetting to include photos or supporting documents

- Filing claims without checking deductible costs

- Using a non-approved or uncertified repair shop

Being thorough and timely can make a major difference in how smoothly your claim is processed.

Helpful Tips for a Smooth Claim Process

A few proactive actions can save time and ensure your glass claim is handled quickly:

- Keep your insurance documents and policy number easily accessible.

- Use your insurer’s app for fast claim filing and status tracking.

- Request written confirmation of your claim approval and repair coverage.

- Ask about repair warranties to ensure workmanship is guaranteed.

- Consider adding zero-deductible glass coverage if you live in an area prone to debris or hail.

Why You Should Use a Certified Glass Repair Specialist

Choosing a certified glass technician is crucial for your safety. Properly installed glass ensures your vehicle’s structure remains strong and your airbags deploy correctly.

Look for glass repair shops that:

- Are certified by the Auto Glass Safety Council (AGSC)

- Use OEM-quality materials and adhesives

- Offer a lifetime warranty on repairs or installations

- Have strong customer reviews or are listed as insurance-approved partners

Working with a trusted professional gives you peace of mind that the repair will last and your claim will be fully honored.

When It Might Be Better Not to File a Claim

Sometimes paying for minor glass damage yourself makes more sense than filing a claim. For example:

- The total repair cost is less than your deductible.

- You’ve filed several claims recently, and another might affect your premium.

- The damage is cosmetic and doesn’t affect safety or visibility.

In these cases, compare quotes from local repair shops. Many offer affordable rates for quick repairs, often under $100 for small chips.

How to Prevent Future Glass Damage

Preventing damage helps you avoid future claims and maintain lower insurance costs.

Smart Habits for Everyday Driving

- Maintain a safe distance behind large trucks and construction vehicles.

- Avoid following snowplows or gravel-hauling vehicles.

- Park in a garage or under cover during storms or high winds.

- Replace wiper blades regularly to avoid scratching your windshield.

- Fix small chips immediately before they spread into large cracks.

Filing a comprehensive insurance claim for glass is a straightforward process when you know what to expect. As a personal vehicle owner, taking a few minutes to document damage, verify coverage, and work with certified professionals ensures your car’s glass is repaired properly and your claim is handled efficiently. Staying proactive about maintenance and safe driving habits can also help you avoid future glass damage and keep your vehicle protected year-round.

Content reviewed and published by SLP AutoGlass Editorial Team.